Using a 1031 Exchange to Upgrade your Residential Investment Property into a Commercial Building

Do you own a residential investment property?

If you are a real estate investor with residential rental properties e.g. a single family home, duplex, quadplex, condo, townhome, vacation rental, or mobile homes affixed to the ground, this article may give you some new insight on when it may be time to consider trading up to invest in Commercial Real Estate. Given the current housing shortage nationwide, residential real estate is hot, and it is a sellers’ market. The rule of thumb goes, Buy Low and Sell High, so, if you have at least $300K-$400K of equity in your current residential investment property, now may be the right time to sell and do a 1031 Exchange to upgrade to a commercial real estate investment.

What is a 1031 Exchange?

A 1031 exchange refers to a section of the Internal Revenue Service (IRS) tax code, that allows taxpayers who own investment properties to defer federal and state capital gains and recaptured depreciation taxes by rolling equity from the sale of one investment property into the purchase of another. There are specific rules and timelines related to a 1031 exchange and it is important to have a knowledgeable specialist handling the process:

-

The property must be held for productive use in a trade or business or held for investment typically for at least 12-24 months. (The property can’t be held for personal use.)

-

The property must be like-kind which is defined as property that is of the same nature, character, or class. As long as both are real property, held for the correct purpose and time (e.g. residential investment property, apartment building, raw land/vacant land, retail building, office building, industrial warehouse, self-storage facility, etc.) and located in the United States, they should qualify for a 1031 Like-Kind Exchange.

The Benefits of using 1031 Exchange to acquire a Commercial Investment Property

-

Scalability – A commercial building with multiple tenants may allow for a landlord to achieve greater management efficiencies given savings on property management and reduced losses due to vacancy. For example, if you currently own a portfolio of six single family homes, each with its own property managers to maintain the infrastructure and systems for each home, upgrading to a single commercial building will likely be more efficient because you will only need to maintain one building and its respective systems. Revenue losses due to vacancy also may be reduced in a multi-tenant commercial building versus single tenant residential property, given a greater likelihood of partial occupancy in at least one or more units on a continuous basis.

-

Tenant Quality - Commercial tenants have audited financial statements that provide detailed insight into their ability to pay rent. If you structure your investment property with a commercial net lease, tenants pay more of the building operating expenses, thus creating a more passive income stream. Below are the definitions of the various net lease types:

-

N – Single Net lease: tenant pays rent + property taxes

-

NN – Double Net lease: tenant pays rent + property taxes + insurance premiums

-

NNN – Triple Net lease: tenant pays rent + property taxes + insurance premiums + maintenance and repairs

-

Absolute NNN: tenant pays rent + property taxes + insurance premiums + maintenance and repairs, including structure and roof (no landlord responsibility except collecting rent)

-

-

Long Term leases – Commercial leases typically have three-to-five-year terms often with negotiated rent increases and options to extend the lease for additional periods. Some properties have even longer terms of 10, 25 or 30 years depending on the location and type of property. Longer lease terms provide income stream predictability to evaluate the investment over the long haul.

-

Improved Returns – Seasoned stock and mutual fund investors diversify their portfolio to mitigate risk and they make changes of what to buy and sell based on market trends. The 1031 Exchange enables investors to apply that same principle to real property. Different segments of commercial real estate may offer varying levels of returns based on demand and swing in values over a 3-to-8-year cycle. For example, a multifamily building in high demand currently may offer a lower yield or average return of about 5% compared to a partially leased retail center with 7% yield that has additional upside to yield 8+% once fully leased. The 1031 Exchange would allow that multifamily owner to transfer his/her equity out of 5% yield building into the retail center with 7-8% yield for the ability to make more money, achieving 2-3 points of incremental returns.

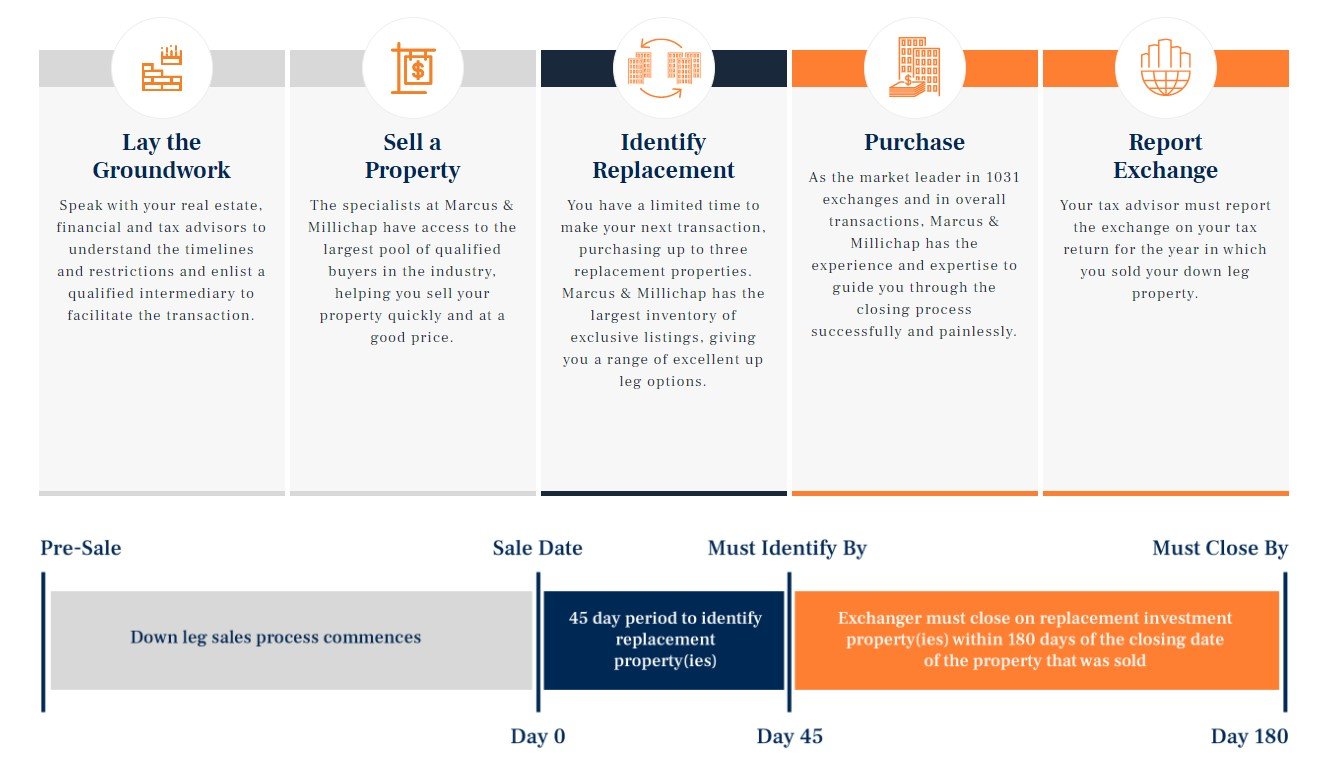

What’s the process to complete a 1031 Exchange?

Below is a visual overview of the steps involved and the required timeline necessary to defer capital gains taxes. It’s best if you consult with your tax accountant, work with a commercial real estate broker for your acquisition and engage a 1031 exchange accommodator who prepares the needed exchange agreement and holds the proceeds of your sale until you complete your acquisition.

To get you started on your upgrade into Commercial Real Estate Investing feel free to schedule a complimentary 30 min virtual consultation with Marsha Anderson, an Associate with Marcus & Millichap, the # 1 commercial real estate investment sales brokerage and capital markets advisory in North America.

.jpg?width=50&name=MarshaAnderson_MM+Headshot%20(1).jpg)